Project solvency2#

solvency2 is a project for building a model to calculate life risks of selected policies at various points in their policy periods based on Solvency II standard formula. This project serves as a reference for building models that contain complex nested projections.

Overview#

The model included in this project is named solvency2.

The model calculates the capital requirement for life underwriting risk

based on Solvency II standard formula by policy and duration.

The overall capital requirement for life underwriting risk, expressed as \(SCR_{life}\), is calculated by aggregating life sub-risks, using a correlation matrix.

Each life sub-risk, as defined in the reference below, is defined as the difference in net asset value under the base (best estimate) scenario and the deterministic scenario with a prescribed stress on the risk factor, except for Lapse risk. For Lapse risk, three (“up”, “down”, “mass”) scenarios are considered.

The model contains a parametric space

SCR_Life[t0, PolicyID, ScenID].

SCR_life() cells in each SCR_Life[t0, PolicyID, ScenID]

holds the value of Life underwriting risk at time t0 for PolicyID

and ScenID (1 by default), calculated based on

the solvency capital requirement standard formula under Solvency II.

Model Structure#

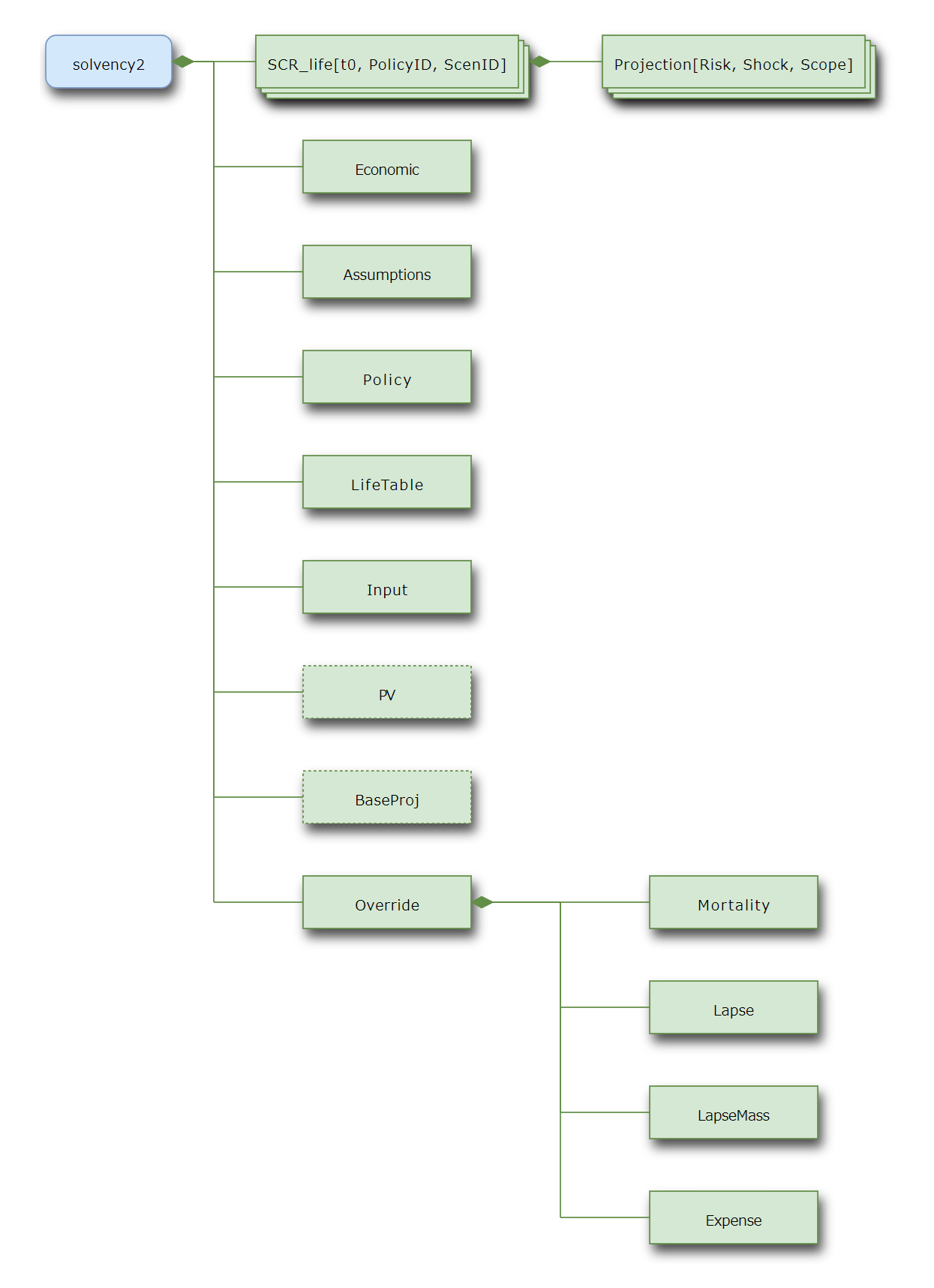

Composition Structure#

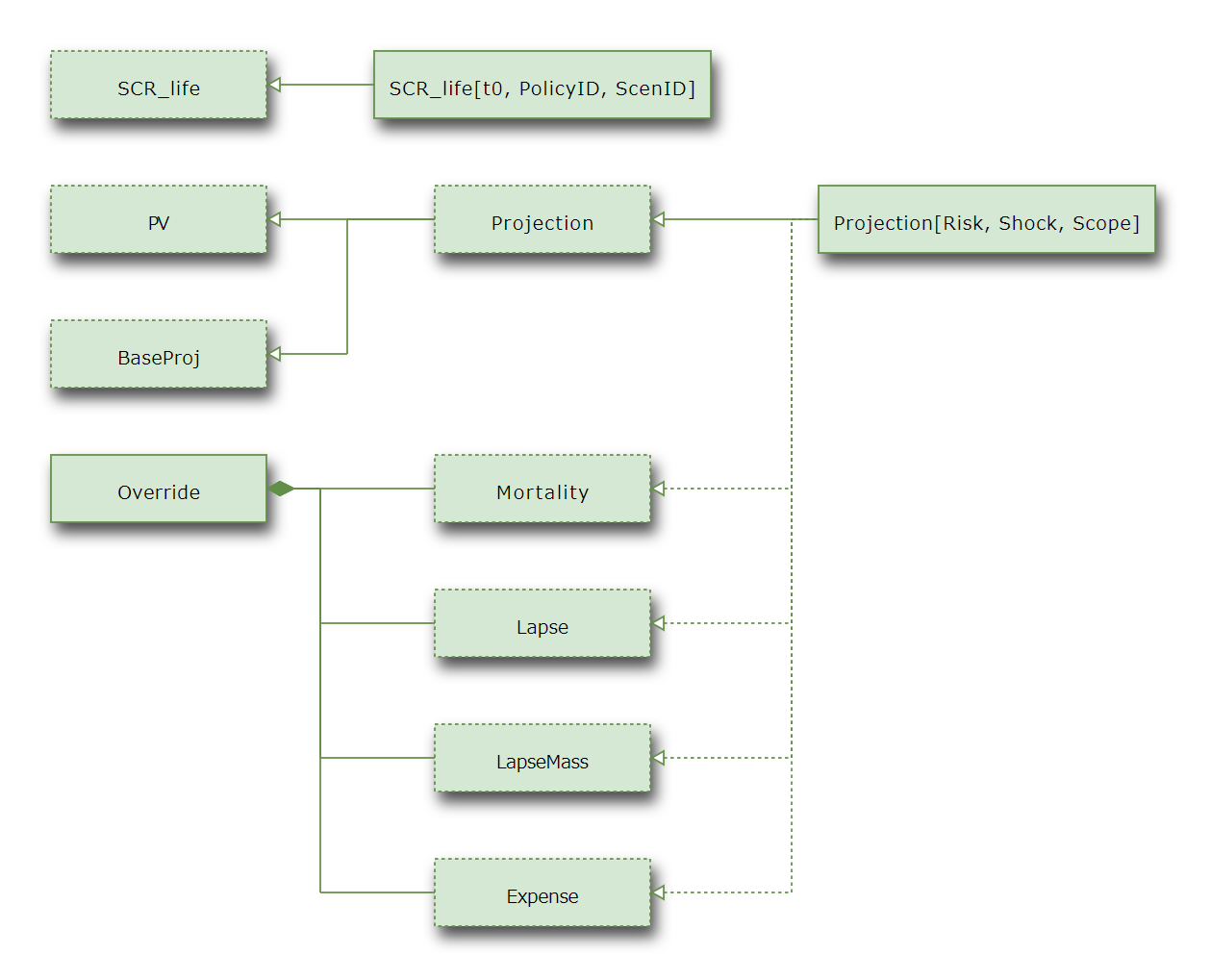

Inheritance Structure#

Space Details#

Assumption input and calculations for individual policies. |

|

Base Space for the |

|

Source module to create |

|

Commutation functions and actuarial notations |

|

Override module for the expense risk calculation |

|

Override module for the lapse risk calculation |

|

Override module for the mass lapse risk calculation |

|

Override module for the mortality/longevity risk calculation |

|

Source module to create |

|

Present Value mix-in Space |

|

Source module for Life SCR standard formulas |