2. Extended Stochastic Example#

This example extends the Simple Stochastic Example, and reflects fee collection, policy decrement, GMDB payouts and dynamic lapse rates.

The Simple Stochastic Example shows how TVOGs on GMADB policies can be calculated by two different methods, the Black-Scholes-Merton formula and Monte-Carlo simulations with risk neutral scenarios. However, the example is too simplified to be practical. It does not consider fees on account value and policy decrement. This example considers the effect of the fee collection and policy decrement. Futhurmore, this example introduces a simple dynamic lapse assumption to make GMAB pay-offs path dependent.

Change summary#

The model for this example is developed by updating CashValue_ME_EX1, named CashValue_ME_EX2 and included in the basiclife library.

The following page shows a complete comparison of formulas in the Projection space between CashValue_ME_EX1 and CashValue_ME_EX2 with highlights on updated parts.

https://www.diffchecker.com/5QHCTyll

The following cells are newly added in CashValue_ME_EX2.

csv_pp: Cash surrender value per policyhas_fees: A switch to turn maintenance fees on and offhas_mortality: A switch to turn mortality decrement on and offhas_lapse: A switch to turn lapse decrement on and offis_lapse_dynamic: A switch to turn dynamic lapse factor on and offmonte_carlo: A summary table showing the time values of guarantees and present value of feespv_maint_fee: Present value of maintenance fees deducted from account value

To specify simulation configurations, following references are newly added.

sim_param_table: A DataFrame containing configuration parameter combinations by simulationsim_id: Selected simulation ID

The formulas of the following cells are updated from CashValue_ME_EX1.

formula_option_put: Paramter \(q\) is introduced to denote continuous dividend yield.lapse_rate: Base lapses are updated and a dynamic factor is consideredmaint_fee_rate: Fee deduction can now be activated/deactivatedmort_rate: Mortality rates are replaced

Following input data is updated.

model_point,model_point_1:age_at_entryis now all 70.mort_table: New rates are taken from the 2019 period life table for the Social Security area population in US

Projection space is now parameterized with sim_id.

Summary, a new space to summarize the results of Projection with various sim_id is introduced.

The following sections discuss in more details each change made on CashValue_ME_EX1 to develop CashValue_ME_EX2.

Click the badge below to run this notebook online on Google Colab. You need a Google account and need to be logged in to it to run this notebook on Google Colab.

The next code cell below is relevant only when you run this notebook on Google Colab. It installs lifelib and creates a copy of the library for this notebook.

[1]:

import sys, os

if 'google.colab' in sys.modules:

lib = 'savings'; lib_dir = '/content/'+ lib

if not os.path.exists(lib_dir):

!pip install lifelib

import lifelib; lifelib.create(lib, lib_dir)

%cd $lib_dir

The code below imports essential modules, reads the CashValue_ME_EX2 model into Python, and defines proj as an alias for the Projection space for convenience.

[2]:

import numpy as np

import pandas as pd

import modelx as mx

model = mx.read_model('CashValue_ME_EX2')

proj = model.Projection

Simulation patterns#

Switches are introduced to activage/deactivate changes made in this example to make it easy to examine the impact of each change. The list below shows the switches and what they control:

has_fees: Whether to deduct maintenance fees from account valuehas_mortality: Whether to reflect mortality decrementhas_lapse: Whether to reflect lapse decrementis_lapse_dynamic: Whether to make lapse assumption dynamic

The sim_param_table DataFrame table defines 5 Simulation IDs from 1 through 5. The first simulation, which is obtained by setting 1 to sim_id, replicates the result from the CashValue_ME_EX1 model. Each of the follwoing simulation turns on one change on top of the previous simulation.

[3]:

proj.sim_param_table

[3]:

| has_fees | has_mortality | has_lapse | is_lapse_dynamic | |

|---|---|---|---|---|

| sim_id | ||||

| 1 | False | False | False | False |

| 2 | True | False | False | False |

| 3 | True | True | False | False |

| 4 | True | True | True | False |

| 5 | True | True | True | True |

The cells representing the switches refer to the sim_param_table and pick up boolean values based on the value of sim_id.

[4]:

proj.has_fees.formula

[4]:

def has_fees():

return sim_param_table['has_fees'][sim_id]

[5]:

proj.has_mortality.formula

[5]:

def has_mortality():

return sim_param_table['has_mortality'][sim_id]

[6]:

proj.has_lapse.formula

[6]:

def has_lapse():

return sim_param_table['has_lapse'][sim_id]

[7]:

proj.is_lapse_dynamic.formula

[7]:

def is_lapse_dynamic():

return sim_param_table['is_lapse_dynamic'][sim_id]

By default, 1 is set to sim_id so all the switches are deactivated.

[8]:

proj.sim_id

[8]:

1

[9]:

proj.has_fees(), proj.has_mortality(), proj.has_lapse() ,proj.is_lapse_dynamic()

[9]:

(False, False, False, False)

Reflecting maintenance fees#

For simplicity, the CashValue_ME_EX1 model in the Simple Stochastic Example omits maintenance fees on account value. In this example, we assume the maintenance fees are deducted from account value at a constant rate of 1% per annum.

The Simple Stochastic Example shows two approaches to calculated the time value of GMAB. Both of the approaches can also be applicable with modification even when the maintenance fees are taken into consideration.

The first approach is to use the Black-Scholes-Merton formula. For calculating the time value of GMAB with fee deduction, an extended form of the formula for European options on a stock paying continuous dividends can be applied. Below is the extended formula, and \(q\) denotes a continuous dividend yield. All the other symbols mean the same as the Simple Stochastic Example.

Reference: Options, Futures, and Other Derivatives by John C.Hull

Accordingly, formula_option_put is updated to reflect \(q\).

[10]:

proj.formula_option_put.formula

[10]:

def formula_option_put(t):

"""

S: prem_to_av

X: claims

sigma: 0.03

r: 0.02

q: 0.01

"""

mps = model_point_table_ext()

cond = mps['policy_term'] * 12 == t

mps = mps.loc[cond]

T = t / 12

S = av_at(0, 'BEF_FEE')[:, 1][cond]

X = (sum_assured() * pols_maturity(t))[:, 1][cond]

sigma = 0.03

r = 0.02

q = 0.01

N = stats.norm.cdf

e = np.exp

d1 = (np.log(S/X) + (r - q + 0.5 * sigma**2) * T) / (sigma * np.sqrt(T))

d2 = d1 - sigma * np.sqrt(T)

return X * e(-r*T) * N(-d2) - S * e(-q*T) * N(-d1)

The time value of GMAB is obtained by passing the maturity month (120) to formula_option_put.

[11]:

proj.formula_option_put(120)

[11]:

point_id

1 1.656494e+06

dtype: float64

The second approach is monte-carlo simulation with risk-neutral scenarios. We model the maintenance fees as a cashflow of fee payments made at the beginning of each month. The maint_fee_rate is updated so that it returns 1/12th of 1% when has_fees is True.

[12]:

proj.maint_fee_rate.formula

[12]:

def maint_fee_rate():

"""Maintenance fee per account value

The rate of maintenance fee on account value each month.

Set to ``0.01 / 12`` by default.

.. seealso::

* :func:`maint_fee`

"""

if has_fees():

return 0.01 / 12

else:

return 0

Setting 2 to sim_id make has_fees return True.

[13]:

proj.sim_id = 2

proj.has_fees()

[13]:

True

A new cells named pv_maint_fee is defined to calculate the present value of maintenance fees.

[14]:

proj.pv_maint_fee.formula

[14]:

def pv_maint_fee():

result = np.array(list(maint_fee(t) for t in range(max_proj_len()))).transpose()

return result @ disc_factors()[:max_proj_len()]

The mean of the present value should be close to \(S_{0}\left(1−e^{-qT}\right)\).

[15]:

proj.pv_maint_fee().mean()

[15]:

4286265.599825707

[16]:

S0 = proj.av_at(0, 'BEF_FEE')[1, 1]

S0 * (1 - np.exp(-0.01 * 10))

[16]:

4282316.188381822

[17]:

proj.pv_maint_fee().mean() / (S0 * (1 - np.exp(-0.01 * 10)))

[17]:

1.0009222605875299

Below is the TVOG calculated by the Monte-Carlo method. The result should be pretty close to the formula result above.

[18]:

proj.pv_claims_over_av('MATURITY').mean()

[18]:

1648013.3849882265

[19]:

proj.pv_claims_over_av('MATURITY').mean() / proj.formula_option_put(120)

[19]:

point_id

1 0.99488

dtype: float64

Adding mortality decrement and GMDB#

Policy decrement is ignored in CashValue_ME_EX1, so we now include policy decrement. We consider mortality decrement first, and add lapse decrement later. The mortality assumption we consider here is deterministic in terms of economic scenarios, so the remaining numbef of policies at maturity or at any other time before maturity should be the same number for all the risk-neutral scenarios.

In addition to the policy decrement, we also take Guaranteed Minimum Death Benefit(GMDB) into consideration.

Note:

In the original CashValue_ME model has a cost of insurance(COI) charge modeled separately from the maintenance fees but the COI charge is removed in CashValue_ME_EX1 in the Simple Stochastic Example for simplicty. This example continues to ignore the COI charge and assumes only the maintenace fees.

The original mortality rates in CashValue_ME are derived by a formula, and are lower than actual mortality rates, so the moratlity table is replaced with a new one. The new table contains male mortality rates taken from the 2019 period life table for the Social Security area population in US.

To make GMDB more observable in comparison to GMAB, the issue age of the model point is changed to 70.

[20]:

proj.model_point_table

[20]:

| spec_id | age_at_entry | sex | policy_term | policy_count | sum_assured | duration_mth | premium_pp | av_pp_init | accum_prem_init_pp | |

|---|---|---|---|---|---|---|---|---|---|---|

| point_id | ||||||||||

| 1 | A | 70 | M | 10 | 100 | 500000 | 0 | 450000 | 0 | 0 |

Now the mortality rates for ages from 70 to 79 range from 2.2% to 5.1%. Since the new mortality table rates do not vary by duration, all the columns in Projection.mort_table have the same values.

[21]:

proj.mort_table['0'][70:80]

[21]:

Age

70 0.022364

71 0.024169

72 0.026249

73 0.028642

74 0.031380

75 0.034593

76 0.038235

77 0.042159

78 0.046336

79 0.050917

Name: 0, dtype: float64

Setting 3 to sim_id activates morality decrement in addition to the maintenance fee deduction considered above.

[22]:

proj.sim_id = 3

proj.has_mortality()

[22]:

True

You can see below that the decrement is deterministic and independent of scenarios.

[23]:

proj.pols_maturity(120)

[23]:

point_id scen_id

1 1 70.356606

2 70.356606

3 70.356606

4 70.356606

5 70.356606

...

9996 70.356606

9997 70.356606

9998 70.356606

9999 70.356606

10000 70.356606

Length: 10000, dtype: float64

The time value of GMAB is dereased from the previous result in proportion to the number of remaining policies at maturity.

[24]:

proj.pv_claims_over_av('MATURITY').mean()

[24]:

1159486.2923001654

The time value of GMDB is also calculated using the same cells by passing 'DEATH' as the argument in place of 'MATURITY'.

[25]:

proj.pv_claims_over_av('DEATH').mean()

[25]:

833826.6659758068

For convenience, the monte_carlo cells is defined, which returns a table showing the time value of GMDB, GMAB, total TVOG, present value of maintenance fees and coverage ratio defined as the present value of maintenance fees divided by the total TVOG.

[26]:

proj.monte_carlo()

[26]:

| GMDB | GMAB | GMxB Total | PV Fees | Coverage Ratio | |

|---|---|---|---|---|---|

| point_id | |||||

| 1 | 833826.665976 | 1.159486e+06 | 1.993313e+06 | 3.728447e+06 | 1.870477 |

Adding lapse decrement#

We also consider lapse decrement, which is ignored in CashValue_ME_EX1.

[27]:

proj.sim_id = 4

proj.has_lapse()

[27]:

True

The original lapse rate assumption in CashValue_ME is altered from 2% decrease per year to 1% decrease to make it more gradual. The dynamic lapse part in the formula is discussed later.

[28]:

proj.lapse_rate.formula

[28]:

def lapse_rate(t):

"""Lapse rate

By default, the lapse rate assumption is defined by duration as::

max(0.1 - 0.01 * duration(t), 0.02)

.. seealso::

:func:`duration`

"""

if has_lapse():

if is_lapse_dynamic():

factor = csv_pp(t) / sum_assured()

else:

factor = 1

return factor * np.maximum(0.1 - 0.01 * duration(t), 0.02)

else:

return pd.Series(0, index=model_point().index)

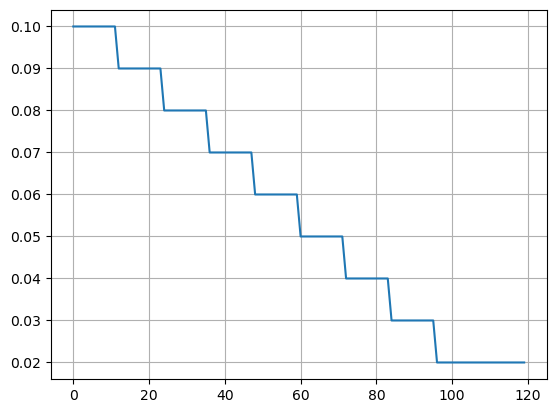

The graph below shows lapse rates by duration. The assumption is deterministic and identical under all the scenarios.

[29]:

pd.Series(

proj.lapse_rate(t).loc[1][1] for t in range(120)

).plot.line(legend=False, grid=True)

[29]:

<Axes: >

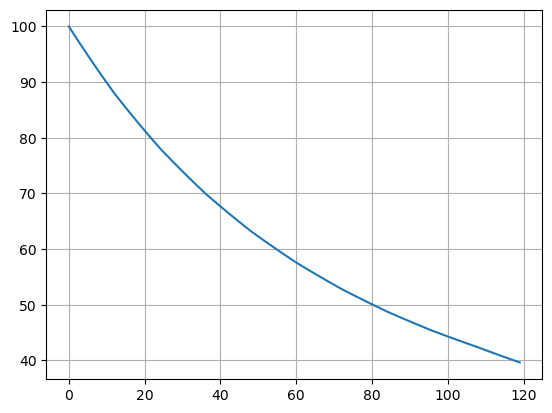

As a result, the number of policies at any point during the policy term is also the same for all the scenarios.

[30]:

pd.Series(

proj.pols_if_at(t, 'BEF_DECR').loc[1][1] for t in range(120)

).plot.line(legend=False, grid=True)

[30]:

<Axes: >

Because the lapse rates are deterministic, the number of lapsed policies during any period and the remaining number of remaining policies do not vary by economic scenarios.

[31]:

proj.pols_maturity(120)

[31]:

point_id scen_id

1 1 39.373692

2 39.373692

3 39.373692

4 39.373692

5 39.373692

...

9996 39.373692

9997 39.373692

9998 39.373692

9999 39.373692

10000 39.373692

Length: 10000, dtype: float64

As with the case for mortality decrement, time value of GMAB is proportional to the number of remaining policy at maturity, and its per policy value is the same as the previous result.

[32]:

proj.monte_carlo()

[32]:

| GMDB | GMAB | GMxB Total | PV Fees | Coverage Ratio | |

|---|---|---|---|---|---|

| point_id | |||||

| 1 | 600183.568334 | 648883.71364 | 1.249067e+06 | 2.668424e+06 | 2.136334 |

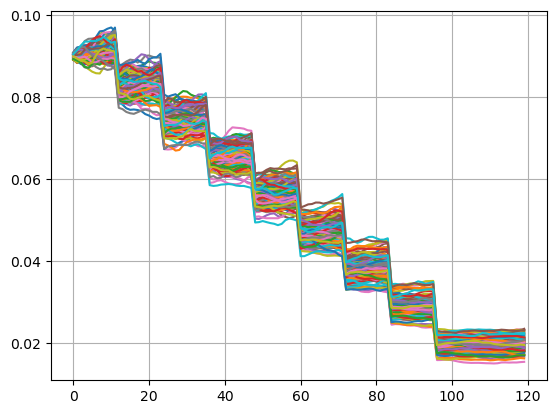

Dynamic lapse assumtpions#

Most variable annuity models include dynamic lapse assumptions. A dynamic lapse assumption is used to reflect such policy holder’s behaviour that they are more likely to terminate their policies when their account values are larger in comparison to the guaranteed amounts of their policies than they are when the account values are smaller than the guaranteed amounts. This behaviour is intuitively undestandable and economically rational because the value of guarantee is smaller when the account value is high and vice versa, given the fees are deducted from the account values at a constan rate.

[33]:

proj.sim_id = 5

proj.is_lapse_dynamic()

[33]:

True

Here we define In-The-Moneyness(ITM) as cash value per policy divided by the guaranteed amount, which represents a factor that the dynamic lapse is driven by. Setting up dynamic lapse assumption would take more effort in reality, but here in this example we simply define the dynamic rapse rate as ITM time base deterministic lapse rate.

[34]:

proj.lapse_rate.formula

[34]:

def lapse_rate(t):

"""Lapse rate

By default, the lapse rate assumption is defined by duration as::

max(0.1 - 0.01 * duration(t), 0.02)

.. seealso::

:func:`duration`

"""

if has_lapse():

if is_lapse_dynamic():

factor = csv_pp(t) / sum_assured()

else:

factor = 1

return factor * np.maximum(0.1 - 0.01 * duration(t), 0.02)

else:

return pd.Series(0, index=model_point().index)

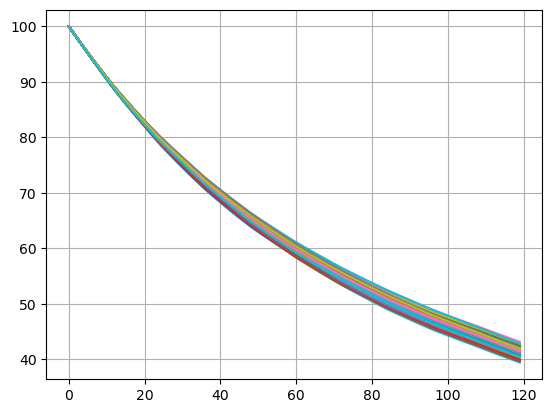

The graph below shows lapse rates by duration under the first 100 scenarios. The second graph shows the number of policies under the same scenarios. Now the policy decrement is dependent on economic scenarios.

[35]:

df = pd.DataFrame({t: proj.lapse_rate(t).loc[1][:100] for t in range(120)})

df.transpose().plot.line(legend=False, grid=True)

[35]:

<Axes: >

[36]:

df = pd.DataFrame({t: proj.pols_if_at(t, 'BEF_DECR').loc[1][:100] for t in range(120)})

df.transpose().plot.line(legend=False, grid=True)

[36]:

<Axes: >

The time value of GMDB and GMAB becomes larger than the previous results because of the policyholder behaviour to take advantage of the guarantees.

[37]:

proj.monte_carlo()

[37]:

| GMDB | GMAB | GMxB Total | PV Fees | Coverage Ratio | |

|---|---|---|---|---|---|

| point_id | |||||

| 1 | 620590.818109 | 690709.245393 | 1.311300e+06 | 2.737674e+06 | 2.087755 |

Summary result#

The Projection space is parameterized with sim_id, so instead of setting a value to Projection.sim_id, you can get a space result for the value by a subscription (or call) operation. For example, Projection[1] yields a space derived from Projection and 1 is set to sim_id in that space. Projection[2] yields a space derived from Projection and 2 is set to sim_id in that space, and so on. These spaces are called item spaces and dynamically created by the

subscription operations. The have the same definitions of cells and references as the definitions in Projection, except for sim_id. Since Projection is parameterized with sim_id, the values passed in the subscriptions are set to sim_id in the dynamic spaces.

The items spaces are useful when you want results for different sim_id values at the same time, instead of one result at a time. The result cells in the Summary space make use of this feature, and it summarizes the results of monte_carlo cells of all the 5 sim_id.

[38]:

proj.parameters

[38]:

('sim_id',)

[39]:

model.Summary.result.formula

[39]:

def result():

data = {sim: Proj[sim].monte_carlo() for sim in range(1, 6)}

return pd.concat(data, names=["sim_id", "point_id"])

[40]:

model.Summary.result()

[40]:

| GMDB | GMAB | GMxB Total | PV Fees | Coverage Ratio | ||

|---|---|---|---|---|---|---|

| sim_id | point_id | |||||

| 1 | 1 | 0.000000 | 3.338084e+05 | 3.338084e+05 | 0.000000e+00 | 0.000000 |

| 2 | 1 | 0.000000 | 1.648013e+06 | 1.648013e+06 | 4.286266e+06 | 2.600868 |

| 3 | 1 | 833826.665976 | 1.159486e+06 | 1.993313e+06 | 3.728447e+06 | 1.870477 |

| 4 | 1 | 600183.568334 | 6.488837e+05 | 1.249067e+06 | 2.668424e+06 | 2.136334 |

| 5 | 1 | 620590.818109 | 6.907092e+05 | 1.311300e+06 | 2.737674e+06 | 2.087755 |

[41]:

model.clear_all()

model.close()