The BasicTerm_SE Model#

Overview#

The BasicTerm_SE model is a variation of BasicTerm_S,

and it projects the cashslows of

in-force policies at time 0 and future new business

policies issued at or after time 0.

While BasicTerm_S is a new business model and it assumes all model points

are issued at time 0, BasicTerm_SE reads the duration of each model

point at time 0 from the model point file.

The duration of a model point being N months (N > 0) means

N months have elapsed before time 0 since the issue of the model point.

If the duration is -N months, the model point is issued

N months after time 0. Premium rates are fed into the model from a table

which is assigned to premium_table.

The rates are calculated by BasicTerm_M.

How to create the table is demonstrated in the

create_premium_table.ipynb

notebook included in this library.

Other specifications of BasicTerm_SE are the same as BasicTerm_S.

The model is a monthly step model and

projects insurance cashflows of a sample model point at a time.

The modeled product is a level-premium plain term product with no surrender value.

The projected cashflows are premiums, claims, expenses and commissions.

The assumptions used are mortality rates, lapse rates, discount rates, expense,

inflation and commission rates.

The present values of the cashflows are also calculated.

The premium amount for each individual model point is calculated as the net

premium with loadings,

where the net premium is calculated from the present value of the claims.

Changes from BasicTerm_S#

Below is the list of

Cells and References that are newly added or updated from BasicTerm_S.

premium_table<new>duration_mth()<new>pols_if_at()<new>pols_new_biz()<new>result_pols()<new>

The number of policies at a certain time can take different values

depending on the timing of policy inflows and outflows at the same time.

To represent different values for the number of policies

depending on the timing of the policy flows,

pols_if_at(t, timing) is introduced.

pols_if_at(t, timing)

calculates the number of policies in-force

at time t and has a parameter named timing in addition to t.

Strings are passed to timing to indicate at what timing the number

of polices in-force is measured.

"BEF_DECR": Before lapse and death"BEF_MAT": Before maturity"BEF_NB": Before new business

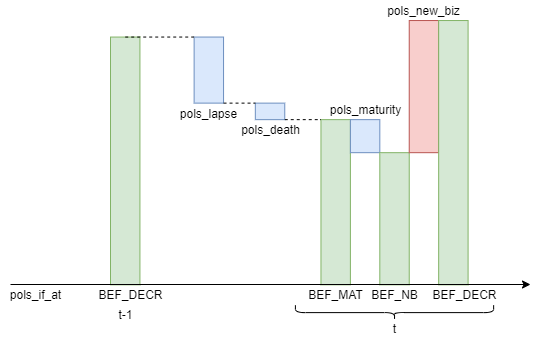

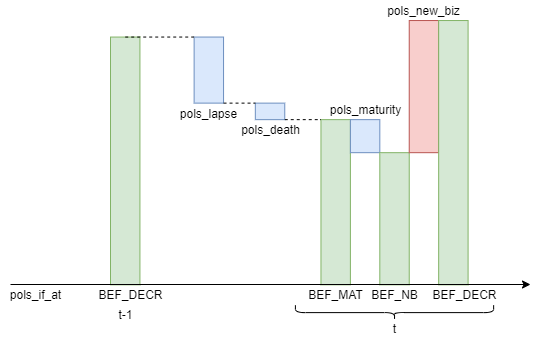

The figure below illustrates how various policy inflows and outflows

are modeled in this model for one calculation step

from time t-1 to time t.

pols_lapse(t) and pols_death(t)

are the number of lapse and death from t-1 to t.

It is assumed that policies mature at the beginning of each month,

and new business policies enter at the beginning of the month

but after the maturity in that month.

model_point_table has the duration_mth column,

and the column is read into the duration_mth(0).

If duration_mth(0) is positive,

the model point is in-force policies and

the number of policies

at time 0 is read from the policy_count column in model_point_table

into pols_if_init(), and

pols_if_at(0, "BEF_MAT") is set from pols_if_init().

duration_mth() increments by 1 each step. If duration_mth()

is negative, policy_count is read into pols_new_biz()

when duration_mth() becomes 0.

Since projections for in-force policies do not start from their issuance,

the premium rates are calculated externaly by

BasicTerm_M and fed into the model as a table.

The premium rates are stored in premium_table.xlsx in the model folder

and read into premium_table as a Series.

Basic Usage#

Reading the model#

Create your copy of the basiclife library by following the steps on the Quick Start page. The model is saved as the folder named BasicTerm_SE in the copied folder.

To read the model from Spyder, right-click on the empty space in MxExplorer, and select Read Model. Click the folder icon on the dialog box and select the BasicTerm_SE folder.

Getting the results#

By default, the model has Cells

for outputting projection results as listed in the

Results section.

result_cf() outputs cashflows of the selected model point,

result_pv() outputs the present values of the cashflows,

result_pols() outputs the decrement table of the model point.

All the Cells outputs the results as pandas DataFrame.

See the Quick Start page for how to get the results in an MxConsole and view the results in MxDataViewer.

Changing the model point#

The model point to be selected is determined by

point_id in Projection.

It is 1 by default.

model_point_table contains all the 10,000 sample model points

as a pandas DataFrame.

To change the model point to another one, set the other model point’s ID

to point_id. Setting the new point_id clears

all the values of Cells that are specific to the previous model point.

Getting multiple results#

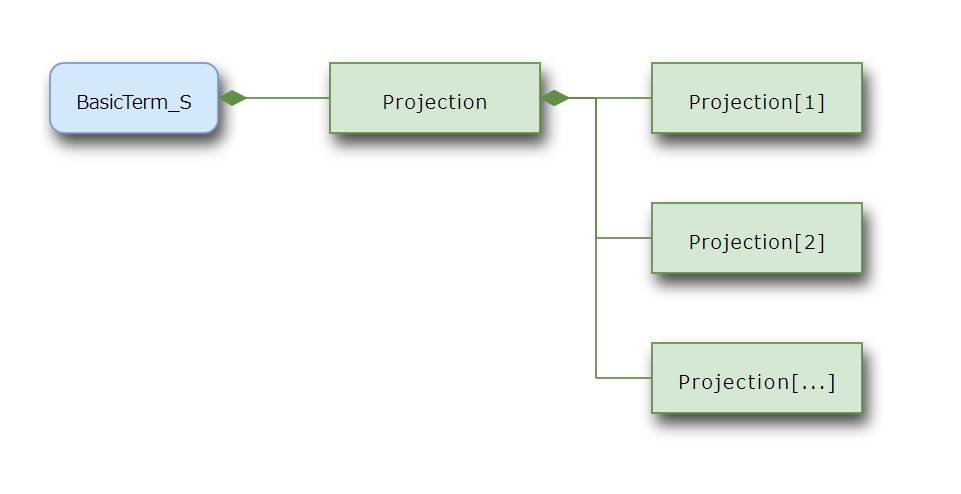

The Projection space

is parameterized with point_id,

i.e. the Projection space can have dynamic child spaces, such as

Projection[1], Projection[2], Projection[3] …, each of which

represents the Projection for each of the model points.

Note

Getting results for too many dynamic child spaces

takes a considerable amount of time.

The default BasicTerm_SE model would take more than a minute

for 1000 model points on an ordinary spec PC.

To calculate for many model points,

consider using the BasicTerm_ME model.

Model Specifications#

The BasicTerm_SE model has only one UserSpace,

named Projection,

and all the Cells and References are defined in the space.

The Projection Space#

The main Space in the BasicTerm_SE model.

Projection is the only Space defined

in the BasicTerm_SE model, and it contains

all the logic and data used in the model.

Parameters and References

(In all the sample code below,

the global variable Projection refers to the

Projection Space.)

- point_id#

The ID of the selected model point.

point_idis defined as a Reference, and its value is used for determining the selected model point. By default,1is assigned. To select another model point, assign its model point ID to it:>>> Projection.point_id = 2

point_idis also defined as the parameter of theProjectionSpace, which makes it possible to create dynamic child space for multiple model points:>>> Projection.parameters ('point_id',) >>> Projection[1] <ItemSpace BasicTerm_SE.Projection[1]> >>> Projection[2] <ItemSpace BasicTerm_SE.Projection[2]>

See also

- model_point_table#

All model points as a DataFrame. The sample model point data was generated by generate_model_points_with_duration.ipynb included in the library. The DataFrame has an index named

point_id, andmodel_point()returns a record as a Series whose index value matchespoint_id. The DataFrame has the following columns:age_at_entrysexpolicy_termpolicy_countsum_assuredduration_mth

Cells defined in

Projectionwith the same names as these columns return the corresponding column’s values for the selected model point.>>> Projection.model_poit_table age_at_entry sex ... sum_assured duration_mth policy_id ... 1 47 M ... 622000 1 2 29 M ... 752000 210 3 51 F ... 799000 15 4 32 F ... 422000 125 5 28 M ... 605000 55 ... .. ... ... ... 9996 47 M ... 827000 157 9997 30 M ... 826000 168 9998 45 F ... 783000 146 9999 39 M ... 302000 11 10000 22 F ... 576000 166 [10000 rows x 6 columns]

The DataFrame is saved in the Excel file model_point_table.xlsx placed in the model folder.

model_point_tableis created by Projection’s new_pandas method, so that the DataFrame is saved in the separate file. The DataFrame has the injected attribute of_mx_dataclident:>>> Projection.model_point_table._mx_dataclient <PandasData path='model_point_table.xlsx' filetype='excel'>

Premium rate table by entry age and duration as a Series. The table is created using

BasicTerm_Mas demonstrated in create_premium_table.ipynb. The table is stored in premium_table.xlsx in the model folder.>>> Projection.premium_table age_at_entry policy_term 20 10 0.000046 15 0.000052 20 0.000057 21 10 0.000048 15 0.000054 ... 58 15 0.000433 20 0.000557 59 10 0.000362 15 0.000471 20 0.000609 Name: premium_rate, Length: 120, dtype: float64

- disc_rate_ann#

Annual discount rates by duration as a pandas Series.

>>> Projection.disc_rate_ann year 0 0.00000 1 0.00555 2 0.00684 3 0.00788 4 0.00866 146 0.03025 147 0.03033 148 0.03041 149 0.03049 150 0.03056 Name: disc_rate_ann, Length: 151, dtype: float64

The Series is saved in the Excel file disc_rate_ann.xlsx placed in the model folder.

disc_rate_annis created by Projection’s new_pandas method, so that the Series is saved in the separate file. The Series has the injected attribute of_mx_dataclident:>>> Projection.disc_rate_ann._mx_dataclient <PandasData path='disc_rate_ann.xlsx' filetype='excel'>

See also

- mort_table#

Mortality table by age and duration as a DataFrame. See basic_term_sample.xlsx included in this library for how the sample mortality rates are created.

>>> Projection.mort_table 0 1 2 3 4 5 Age 18 0.000231 0.000254 0.000280 0.000308 0.000338 0.000372 19 0.000235 0.000259 0.000285 0.000313 0.000345 0.000379 20 0.000240 0.000264 0.000290 0.000319 0.000351 0.000386 21 0.000245 0.000269 0.000296 0.000326 0.000359 0.000394 22 0.000250 0.000275 0.000303 0.000333 0.000367 0.000403 .. ... ... ... ... ... ... 116 1.000000 1.000000 1.000000 1.000000 1.000000 1.000000 117 1.000000 1.000000 1.000000 1.000000 1.000000 1.000000 118 1.000000 1.000000 1.000000 1.000000 1.000000 1.000000 119 1.000000 1.000000 1.000000 1.000000 1.000000 1.000000 120 1.000000 1.000000 1.000000 1.000000 1.000000 1.000000 [103 rows x 6 columns]

The DataFrame is saved in the Excel file mort_table.xlsx placed in the model folder.

mort_tableis created by Projection’s new_pandas method, so that the DataFrame is saved in the separate file. The DataFrame has the injected attribute of_mx_dataclident:>>> Projection.mort_table._mx_dataclient <PandasData path='mort_table.xlsx' filetype='excel'>

See also

Projection parameters#

The time step of the model is monthly. Cashflows and other time-dependent

variables are indexed with t.

Projection is carried out separately for individual model points.

proj_len() calculates the number of months to be

projected for the selected model point.

Cashflows and other flows that accumulate throughout a period

indexed with t denote the sums of the flows from t til t+1.

Balance items indexed with t denote the amount at t.

|

Projection length in months |

Model point data#

The model point data is stored in an Excel file named model_point_table.xlsx under the model folder.

The selected model point as a Series |

|

|

The sex of the selected model point |

The sum assured of the selected model point |

|

The policy term of the selected model point. |

|

|

The attained age at time t. |

The age at entry of the selected model point |

|

|

Duration of the selected model point at |

|

Duration of the selected model point at |

Assumptions#

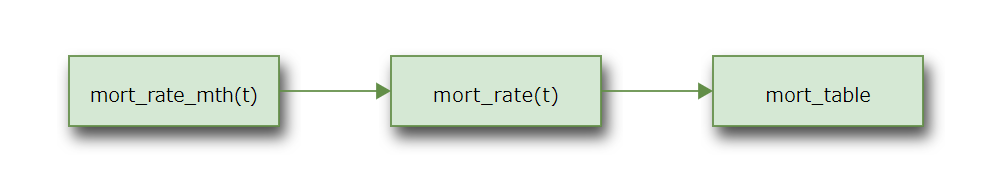

The mortality table is stored in an Excel file named mort_table.xlsx

under the model folder, and is read into mort_table as a DataFrame.

mort_rate() looks up mort_table and picks up

the annual mortality rate to be applied for the selected

model point at time t.

mort_rate_mth() converts mort_rate() to the monthly mortality

rate to be applied during the month starting at time t.

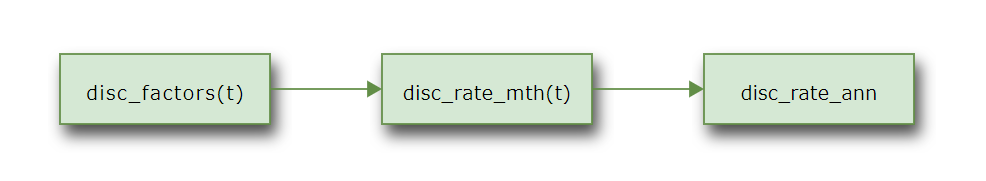

The discount rate data is stored in an Excel file named disc_rate_ann.xlsx

under the model folder, and is read into disc_rate_ann as a Series.

The lapse by duration is defined by a formula in lapse_rate().

expense_acq() holds the acquisition expense per policy at t=0.

expense_maint() holds the maintenance expense per policy per annum.

The maintenance expense inflates at a constant rate

of inflation given as inflation_rate().

|

Mortality rate to be applied at time t |

Monthly mortality rate to be applied at time t |

|

Discount factors. |

|

Monthly discount rate |

|

|

Lapse rate |

Acquisition expense per policy |

|

Annual maintenance expense per policy |

|

The inflation factor at time t |

|

Inflation rate |

Policy values#

By default, the amount of death benefit for each policy (claim_pp())

is set equal to sum_assured.

The payment method is monthly whole term payment for all model points.

The monthly premium per policy (premium_pp())

is calculated for each policy

as sum_assured() times the premium rate in premium_table.

for age_at_entry() and policy_term() of the policy.

net_premium_pp() and loading_prem() are not used

in BasicTerm_SE and BasicTerm_ME.

This product is assumed to have no surrender value.

|

Claim per policy |

Net premium per policy |

|

Loading per premium |

|

Monthly premium per policy |

Policy decrement#

At t=0

If the selected model point represents in-force policies, i.e.

the duration_mth of the model point in model_point_table

is positive, pols_if_at(0, "BEF_MAT") is set to

the value through pols_if_init().

At each projection step

pols_if_at(t, timing) represents

the number of policies at t.

The timing parameter can take the following string values.

"BEF_MAT": Before maturity"BEF_NB": Before new business"BEF_DECR": Before lapse and death

Policy flows and in-force at each timing from t-1 to t

are calculated recursively as follows:

pols_if_at(t-1, "BEF_DECR")is calculated by addingpols_new_biz(t-1)topols_if_at(t-1, "BEF_NB").pols_if_at(t, "BEF_MAT")is calculated by deductingpols_lapse(t)andpols_death(t)frompols_if_at(t-1, "BEF_DECR").pols_if_at(t, "BEF_NB")is calculated by deductingpols_maturity(t)frompols_if_at(t, "BEF_MAT").pols_if_at(t, "BEF_DECR")is calculated bypols_new_biz(t)frompols_if_at(t, "BEF_NB").

It is assumed that policies mature at the beginning of each month,

and new business policies enter at the beginning of the month

but after the maturity in that month.

pols_if(t) is an alias

for pols_if_at(t, "BEF_MAT").

The figure below illustrates how various policy inflows and outflows

are modeled in this model for one calculation step

from time t-1 to time t.

|

Number of death occurring at time t |

|

Number of policies in-force |

|

Number of policies in-force |

Initial number of policies in-force |

|

|

Number of lapse occurring at time t |

Number of maturing policies |

|

|

Number of new business policies |

Cashflows#

An acquisition expense at t=0 and maintenance expenses thereafter comprise expense cashflows.

Commissions are assumed to be paid out during the first policy year and the commission amount is assumed to be 100% premium during the first year and 0 afterwards.

|

Claims |

|

Commissions |

|

Premium income |

|

Expenses |

|

Net cashflow |

Present values#

The Cells whose names start with pv_ are for calculating

the present values of the cashflows indicated by the rest of their names.

pv_pols_if() is not used

in BasicTerm_SE and BasicTerm_ME.

Present value of claims |

|

Present value of commissions |

|

Present value of expenses |

|

Present value of net cashflows. |

|

Present value of policies in-force |

|

Present value of premiums |

|

Check present value summation |

Results#

result_cf() outputs the cashflows of the selected model point

as a DataFrame:

>>> result_cf()

Premiums Claims Expenses Commissions Net Cashflow

0 8156.240000 2939.548223 430.000000 8156.240000 -3369.548223

1 8084.493113 2913.690299 426.217477 8084.493113 -3339.907776

2 8013.377352 2888.059836 422.468228 8013.377352 -3310.528064

3 7942.887165 2862.654832 418.751959 7942.887165 -3281.406792

4 7873.017050 2837.473306 415.068381 7873.017050 -3252.541687

.. ... ... ... ... ...

115 5416.841591 5512.481202 312.332343 0.000000 -407.971953

116 5406.889171 5502.353062 311.758491 0.000000 -407.222382

117 5396.955036 5492.243531 311.185694 0.000000 -406.474188

118 5387.039154 5482.152574 310.613949 0.000000 -405.727369

119 0.000000 0.000000 0.000000 0.000000 0.000000

result_pv() outputs the present values of the cashflows

and also their percentages against the present value of premiums as a DataFrame:

>>> result_pv()

Premiums Claims Expenses Commissions Net Cashflow

PV 708379.130574 474803.297001 38902.884356 85874.887301 108798.061916

Result table of cashflows |

|

Result table of present value of cashflows |

|

Result table of policy decrement |

Cells Descriptions#

- proj_len()[source]#

Projection length in months

proj_len()indicates how many months the projection for the selected model point should be carried out. Defined as:12 * policy_term() - duration_mth(0) + 1

See also

- model_point()[source]#

The selected model point as a Series

model_point()looks upmodel_point_table, and returns as a Series the row whose index is the value ofpoint_id.Example

In the code below

Projectionrefers to theProjectionspace:>>> Projection.point_id 1 >>> Projection.model_point() age_at_entry 47 sex M policy_term 10 policy_count 86 sum_assured 622000 duration_mth 1 Name: 1, dtype: object >>> Projection.point_id = 2 >>> Projection.model_point() age_at_entry 29 sex M policy_term 20 policy_count 56 sum_assured 752000 duration_mth 210 Name: 2, dtype: object

- sex()[source]#

The sex of the selected model point

Note

This cells is not used by default.

The element labeled

sexof the Series returned bymodel_point().

- sum_assured()[source]#

The sum assured of the selected model point

The element labeled

sum_assuredof the Series returned bymodel_point().

- policy_term()[source]#

The policy term of the selected model point.

The element labeled

policy_termof the Series returned bymodel_point().

- age_at_entry()[source]#

The age at entry of the selected model point

The element labeled

age_at_entryof the Series returned bymodel_point().

- duration_mth(t)[source]#

Duration of the selected model point at

tin monthsIndicates how many months the policies have been in-force at

t. The initial value at time 0 is read from theduration_mthcolumn inmodel_point_tablethroughmodel_point(). Increments by 1 astincrements. Negative values ofduration_mth()indicate future new business policies. For example, If theduration_mth()is -15 at time 0, the model point is issued att=15.See also

- disc_factors()[source]#

Discount factors.

Vector of the discount factors as a Numpy array. Used for calculating the present values of cashflows.

See also

- disc_rate_mth()[source]#

Monthly discount rate

Nummpy array of monthly discount rates from time 0 to

proj_len()- 1 defined as:(1 + disc_rate_ann)**(1/12) - 1

See also

- lapse_rate(t)[source]#

Lapse rate

By default, the lapse rate assumption is defined by duration as:

max(0.1 - 0.02 * duration(t), 0.02)

See also

- claim_pp(t)[source]#

Claim per policy

The claim amount per plicy. Defaults to

sum_assured().

Net premium per policy

Note

This cells is not used by default.

The net premium per policy is defined so that the present value of net premiums equates to the present value of claims:

pv_claims() / pv_pols_if()

See also

- loading_prem()[source]#

Loading per premium

Note

This cells is not used by default.

0.5by default.See also

Monthly premium per policy

Monthly premium amount per policy defined as:

round(sum_assured() * premium_table[age_at_entry(), policy_term()], 2)

- pols_if(t)[source]#

Number of policies in-force

pols_if(t)is an alias forpols_if_at(t, "BEF_MAT").See also

- pols_if_at(t, timing)[source]#

Number of policies in-force

pols_if_at(t, timing)calculates the number of policies in-force at timet. The second parametertimingtakes a string value to indicate the timing of in-force, which is either"BEF_MAT","BEF_NB"or"BEF_DECR".BEF_MAT

The number of policies in-force before maturity after lapse and death. At time 0, the value is read from

pols_if_init(). For time > 0, defined as:pols_if_at(t-1, "BEF_DECR") - pols_lapse(t-1) - pols_death(t-1)

BEF_NB

The number of policies in-force before new business after maturity. Defined as:

pols_if_at(t, "BEF_MAT") - pols_maturity(t)

BEF_DECR

The number of policies in-force before lapse and death after new business. Defined as:

pols_if_at(t, "BEF_NB") + pols_new_biz(t)

- pols_if_init()[source]#

Initial number of policies in-force

Number of in-force policies at time 0 referenced from

pols_if_at(0, "BEF_MAT").

- pols_maturity(t)[source]#

Number of maturing policies

The policy maturity occurs when

duration_mth()equals 12 timespolicy_term(). The amount is equal topols_if_at(t, "BEF_MAT").otherwise

0.

- pols_new_biz(t)[source]#

Number of new business policies

The number of new business policies. The value

duration_mth(0)for the selected model point is read from thepolicy_countcolumn inmodel_point(). If the value is 0 or negative, the model point is new business at t=0 or at t whenduration_mth(t)is 0, and thepols_new_biz(t)is read from thepolicy_countinmodel_point().See also

- claims(t)[source]#

Claims

Claims during the period from

ttot+1defined as:claim_pp(t) * pols_death(t)

See also

- commissions(t)[source]#

Commissions

By default, 100% premiums for the first year, 0 otherwise.

See also

Premium income

Premium income during the period from

ttot+1defined as:premium_pp() * pols_if_at(t, "BEF_DECR")

See also

- expenses(t)[source]#

Expenses

Expenses during the period from

ttot+1defined as the sum of acquisition expenses and maintenance expenses. The acquisition expenses are modeled asexpense_acq()timespols_new_biz(). The maintenance expenses are modeled asexpense_maint()timesinflation_factor()timespols_if_at()before decrement.

- net_cf(t)[source]#

Net cashflow

Net cashflow for the period from

ttot+1defined as:premiums(t) - claims(t) - expenses(t) - commissions(t)

See also

- pv_net_cf()[source]#

Present value of net cashflows.

Defined as:

pv_premiums() - pv_claims() - pv_expenses() - pv_commissions()

- pv_pols_if()[source]#

Present value of policies in-force

Note

This cells is not used by default.

The discounted sum of the number of in-force policies at each month. It is used as the annuity factor for calculating

net_premium_pp().

Present value of premiums

See also

- check_pv_net_cf()[source]#

Check present value summation

Check if the present value of

net_cf()matches the sum of the present values each cashflows. Returns the check result asTrueorFalse.See also