IFRS#

Source module for IFRS17 CSM amortization simulation

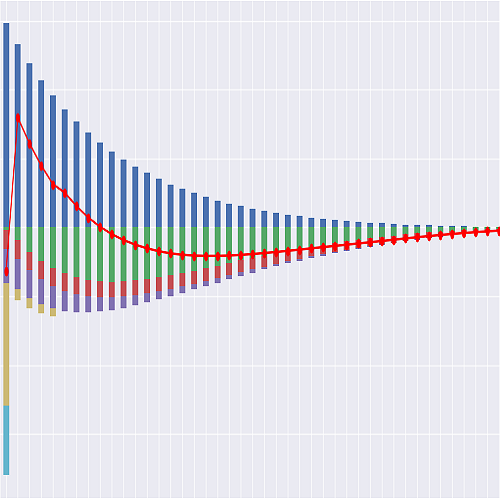

This module contains formulas to simulate amortization of contract service margin (CSM) defined in IFRS17.

This module is a mix-in module to projection module in nestedlife project.

Cells

|

Accumulated cashflows |

Ratio of PV Acquisiton Cashflows to PV Premiums. |

|

|

Acutal net cashflow |

Adjustment to CSM for changes in fulfilment cashflows (44(c)->B96-B100) |

|

Adjustment to Loss Component for changes in fulfilment cashflows |

|

Amortization of Acquisition Cash Flows |

|

Non-financial assumption changes |

|

|

floored CSM (38, 44) |

Unfloored CSM (38, 44) |

|

|

The number of coverage units at t after new business |

|

The number of coverage units at t |

Expected Acquisition Cashflow |

|

|

Expected Claims |

|

Expected Expenses |

|

Expected Interest on future cashflows |

Expected Premium Income |

|

Increase in Loss Component |

|

|

Incurred Claims |

|

Incurred Expenses |

Insurance Service Result (80(a), 83-86) |

|

Insurance Finance Income or Expenses (80(b), 87-92, B128-B136) |

|

|

Insurance Revenue (82-85, B120-B125) |

Insurance Service Expense (103(b)) |

|

|

Interest accreted on CSM (44(b)) |

Investment Components in Incur Claims |

|

|

Loss Component |

|

Net insurance assets plus accumulated cashflows. |

Net Insurance Assets or Liabilities |

|

|

Present value of future cashflows |

|

Present value of future cashflows |

|

Present value of cumulatvie coverage units |

|

IFRS Profit before tax |

|

Release of Risk Adjustment to Revenue |

Risk Adjustment |

|

Transfer of services (44(e)->B119) |

- AcqPremRatio()[source]#

Ratio of PV Acquisiton Cashflows to PV Premiums.

The ratio is determined by the expectation at issue.

- AdjCSM_FlufCF(t)[source]#

Adjustment to CSM for changes in fulfilment cashflows (44(c)->B96-B100)

Warning

Only B96(b) changes in PV of the future cashflows are implemented.

TODO: Risk Adjustment is yet to be implemented. At the momement this adjustment only considers present value of future cashflows.

TODO: Loss component for onerous contracts are yet to be implemented. At the momemnt this adjustment allows negative CSM.

- AmortAcqCashflow(t)[source]#

Amortization of Acquisition Cash Flows

Warning

Implemented as a constant percentage of actual premiums, thus not totalling the original amount if actual != expected.

- InsurFinIncomeExps(t)[source]#

Insurance Finance Income or Expenses (80(b), 87-92, B128-B136)

Warning

Accounting Policy Choice 88(b) not implemented.

- NetInsurAssets(t)[source]#

Net Insurance Assets or Liabilities

Warning

The liabilities for incurred claims are not implemented.

- PV_Cashflow(t, t_at, t_rate)[source]#

Present value of future cashflows

This formula takes 3 time parameters. The projection starts from t, and the projected cashflows are discounted back to t_at. The discount rates applied are the ones at t_rate.

- Parameters:

t – Time from which the projection

t_at – Time discount rates at which are used.

t_rate – Time to which the cashflows are discounted.