The Scenarios Space#

The space representing economic data

This space is parameterized with date_id and sens_id.

For each combination of date_id and sens_id values,

a dynamic subspace of this space is created,

representing a specific set of economic assumptions.

By default, the following scenarios are supported. Users should customize the contents of this space to meet their own needs.

Deterministic interest rate scenarios

Stochastic risk-neutral index return scenarios

For the interest rate scenarios,

spot_rates() in this space reads annual spot rates from an Excel file into it.

spot_rates() uses sens_is as a key to select a sheet from the file.

For the stochastic risk-neutral index return scenarios,

log_return_mth() generates stochastic returns,

from the interest rates and volatility parameters read from an Excel file.

Parameters

- date_id#

a string key representing the base date

- sens_id#

a string key representing interest rate sensitivity, which is either “BASE”, “UP” or “DOWN”.

References in the space

Example

The sample code below demonstrates how to examine the contents of

Scenarios

for specific values of date_id and sens_id, ‘202312’ and ‘BASE’.

>>> import modelx as mx

>>> m = mx.read_model("IntegratedLife")

>>> m.Scenarios['202312', 'BASE'].spot_rates()

EUR GBP JPY USD

0 0.03357 0.04735 0.00072 0.04760

1 0.02690 0.04021 0.00191 0.04056

2 0.02439 0.03668 0.00280 0.03724

3 0.02350 0.03475 0.00363 0.03571

4 0.02323 0.03355 0.00448 0.03499

.. ... ... ... ...

145 0.03241 0.03229 0.03006 0.03364

146 0.03243 0.03231 0.03010 0.03365

147 0.03244 0.03232 0.03013 0.03365

148 0.03245 0.03234 0.03016 0.03366

149 0.03247 0.03235 0.03019 0.03366

[150 rows x 4 columns]

>>> m.Scenarios['202312', 'BASE'].forward_rates()

EUR GBP JPY USD

0 0.033570 0.047350 0.000720 0.047600

1 0.020273 0.033119 0.003101 0.033567

2 0.019388 0.029656 0.004582 0.030632

3 0.020835 0.028982 0.006124 0.031134

4 0.022151 0.028764 0.007887 0.032115

.. ... ... ... ...

145 0.033861 0.033741 0.034419 0.035091

146 0.035354 0.035234 0.035957 0.035111

147 0.033911 0.033791 0.034550 0.033650

148 0.033931 0.035304 0.034610 0.035141

149 0.035454 0.033841 0.034670 0.033660

[150 rows x 4 columns]

>>> m.Scenarios['202312', 'BASE'].cont_fwd_rates()

EUR GBP JPY USD

0 0.033019 0.046263 0.000720 0.046502

1 0.020070 0.032582 0.003097 0.033016

2 0.019203 0.029225 0.004572 0.030172

3 0.020621 0.028570 0.006105 0.030659

4 0.021909 0.028358 0.007856 0.031610

.. ... ... ... ...

145 0.033300 0.033184 0.033840 0.034489

146 0.034744 0.034628 0.035325 0.034509

147 0.033349 0.033233 0.033966 0.033096

148 0.033368 0.034695 0.034024 0.034538

149 0.034840 0.033281 0.034082 0.033106

[150 rows x 4 columns]

>>> m.Scenarios['202312', 'BASE'].log_return_mth()

FUND1 FUND2 FUND3 FUND4 FUND5 FUND6

scen t

1 0 -0.030397 0.047032 -0.010060 0.000816 0.000665 -0.040567

1 -0.029103 0.025734 0.004162 -0.018741 0.084592 0.058125

2 -0.015052 0.034508 -0.005399 0.003108 0.030602 -0.070345

3 0.015784 0.051717 0.015262 0.000348 0.034553 -0.091414

4 -0.001168 0.018826 -0.015521 0.002865 0.063022 0.153368

... ... ... ... ... ...

100 1795 0.005044 0.005891 0.006421 -0.009772 0.006747 -0.018034

1796 0.005050 -0.030197 -0.027247 0.002810 -0.017504 0.011297

1797 0.070869 0.008339 0.012401 -0.002405 0.014219 -0.023541

1798 -0.001515 0.049597 0.013523 -0.015077 0.070503 0.027821

1799 0.000753 -0.019089 0.017222 0.004629 0.005042 0.000108

[180000 rows x 6 columns]

>>> m.Scenarios['202312', 'BASE'].return_mth()

FUND1 FUND2 FUND3 FUND4 FUND5 FUND6

scen t

1 0 -0.029940 0.048156 -0.010010 0.000816 0.000665 -0.039755

1 -0.028684 0.026068 0.004171 -0.018567 0.088273 0.059847

2 -0.014940 0.035111 -0.005384 0.003113 0.031075 -0.067928

3 0.015909 0.053078 0.015379 0.000348 0.035157 -0.087360

4 -0.001168 0.019004 -0.015401 0.002869 0.065050 0.165754

... ... ... ... ... ...

100 1795 0.005057 0.005909 0.006442 -0.009724 0.006770 -0.017872

1796 0.005063 -0.029746 -0.026880 0.002814 -0.017352 0.011361

1797 0.073441 0.008374 0.012478 -0.002402 0.014320 -0.023266

1798 -0.001514 0.050848 0.013615 -0.014964 0.073048 0.028211

1799 0.000753 -0.018908 0.017371 0.004640 0.005055 0.000108

[180000 rows x 6 columns]

Formulas#

Spot interest rates by duration and currency |

|

Forward interest rates by duration and currency |

|

Volatilities of fund indexes |

|

Stochastic scenarios of fund indexes as monthly risk-neutral log returns |

|

Fund index parameters |

|

The number of func indexes |

|

Monthly index returns |

Cells Descriptions#

- spot_rates()[source]#

Spot interest rates by duration and currency

Reads annual spot interest rates for multiple currencies from an Excel file, and returns them as a pandas DataFrame. The index and columns of the DataFrame represents duration years and currencies respectively

The directory of the Excel file is specified by the user as a constant parameter named “scen_dir”.

- forward_rates()[source]#

Forward interest rates by duration and currency

Returns annual forward interest rates for multiple currencies as a pandas DataFrame, calculated from

spot_rates().

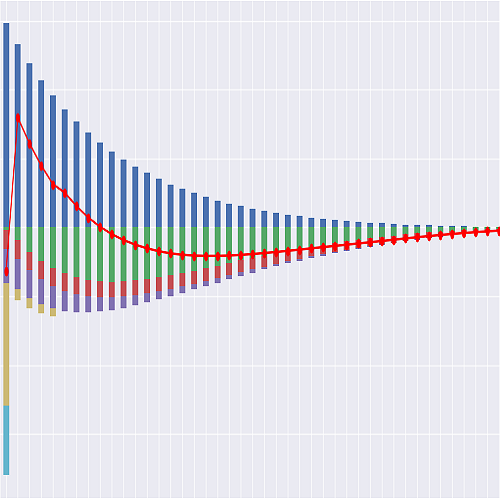

- log_return_mth()[source]#

Stochastic scenarios of fund indexes as monthly risk-neutral log returns

Generates stochastic scenarios of fund indexes Generates monthly risk-neutral log returns of fund indexes, Returns a DataFrame with columns of fund IDs and with a MultiIndex with two levels, scenario ID and time in month.