The BasicTerm_ME Model#

Overview#

The BasicTerm_ME model is a faster reimplementation of

the BasicTerm_SE model.

The BasicTerm_ME model reproduces the same results as

BasicTerm_SE much faster.

Each formula to be applied to all the model points

operates on the entire set of model points at once

with the help of Numpy and Pandas.

The default product specs, assumptions and input data

are the same as BasicTerm_SE.

Changes from BasicTerm_M#

Below is the list of

Cells and References that are newly added or updated from BasicTerm_M.

premium_table<new>duration_mth<new>pols_if_at()<new>pols_new_biz()<new>result_pols()<new>

In summary, below are the main changes

common to BasicTerm_ME and BasicTerm_SE.

Refer to the descritpion for BasicTerm_SE for

more details.

model_point_tablehas theduration_mthcolumn, to indicate the duration of the model point at time 0,pols_if_at(t, timing)is introduced to allow multiple values for the number of policy in-force at the same time at different policy flow timing.premium_tableholds premium rate data calculated outside the model.

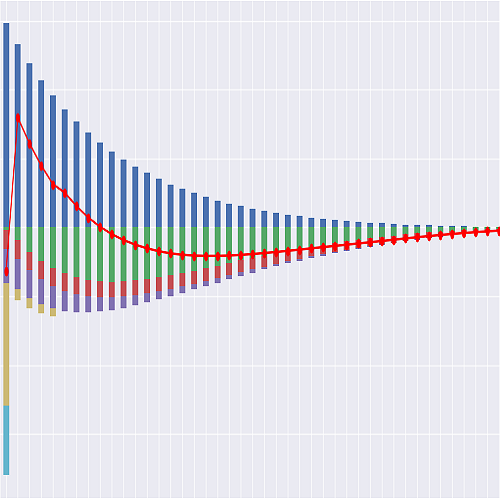

Speed comparison#

The main advantage of the BasicTerm_ME model over the

BasicTerm_SE model is its speed.

Below is the result of a simple speed comparison between the two models.

The machine used for this comparison is a consumer PC equipped

with Intel Core i5-6500T CPU and 16GB RAM.

>>> timeit.timeit("[Projection[i].pv_net_cf() for i in range(1, 101)]", globals=globals(), number=1)

5.971486999999996

>>> timeit.timeit("pv_net_cf()", globals=globals(), number=1)

3.9130262000000045

Note that only the first 100 model points were run with BasicTerm_SE

while all the 10000 model points were run with BasicTerm_ME.

While BasicTerm_SE took about 6.0 seconds for the 100 model points,

BasicTerm_ME took only 3.9 seconds for the 10000 model points.

This means BasicTerm_ME

runs about 153 times faster than BasicTerm_SE.

The run time of BasicTerm_SE

is shorter that BasicTerm_S because

the projection length of each model point is shorter for

BasicTerm_SE.

Formula examples#

Most formulas in the BasicTerm_ME model

are the same as those in BasicTerm_SE.

However, some formulas are updated since they cannot

be applied to vector operations without change.

For example, below shows how

pols_maturity, the number of maturing policies

at time t, is defined differently in

BasicTerm_SE and in

BasicTerm_ME.

def pols_maturity(t):

if duration_mth(t) == policy_term() * 12:

return pols_if_at(t, "BEF_MAT")

else:

return 0

def pols_maturity(t):

return (duration_mth(t) == policy_term() * 12) * pols_if_at(t, "BEF_MAT")

In BasicTerm_SE,

policy_term() returns an integer,

such as 10 indicating a policy term of the selected model point in years,

so the if clause checks if the value of duration_mth()

is equal to the policy term in month:

>>> policy_term()

10

>>> pols_maturity(120)

0.6534679117893804

In contrast, policy_term() in BasicTerm_ME returns

a Series of policy terms of all the model points.

If the if clause were

defined in the same way as in the BasicTerm_SE,

it would result in an error,

because the condition duration_mth(t) == policy_term() * 12 for a certain t

returns a Series of boolean values and it is ambiguous

for the Series to be in the if condition.

Further more, whether the if branch or the else branch should

be evaluated needs to be determined element-wise,

but the if statement would not allow such element-wise branching.

Instead of using the if statement, the formula in BasicTerm_ME

achieves the element-wise conditional operation by multiplication

by a Series of boolean values.

In the formula in BasicTerm_ME,

pols_if_at(t, "BEF_MAT")

returns the numbers of policies at time t for all the model points

as a Series.

Multiplying it

by (duration_mth(t) == policy_term() * 12) replaces

the numbers of policies with 0 for model points whose policy terms in month

are not equal to t. This operation is effectively an element-wise if

operation:

>>> policy_term()

point_id

1 10

2 20

3 10

4 20

5 15

..

9996 20

9997 15

9998 20

9999 20

10000 15

Name: policy_term, Length: 10000, dtype: int64

>>> (duration_mth(119) == policy_term() * 12)

policy_id

1 True

2 False

3 False

4 False

5 False

9996 False

9997 False

9998 False

9999 False

10000 False

Length: 10000, dtype: bool

>>> pols_maturity(119)

policy_id

1 56.696979

2 0.000000

3 0.000000

4 0.000000

5 0.000000

9996 0.000000

9997 0.000000

9998 0.000000

9999 0.000000

10000 0.000000

Length: 10000, dtype: float64

Since projections for in-force policies do not start from their issuance,

the premium rates are calculated externaly by

BasicTerm_M and fed into the model as a table.

The premium rates are stored in premium_table.xlsx in the model folder

and read into premium_table as a Series.

Basic Usage#

Reading the model#

Create your copy of the basiclife library by following

the steps on the Quick Start page.

The model is saved as the folder named BasicTerm_ME in the copied folder.

To read the model from Spyder, right-click on the empty space in MxExplorer,

and select Read Model.

Click the folder icon on the dialog box and select the

BasicTerm_ME folder.

Getting the results#

By default, the model has Cells

for outputting projection results as listed in the

Results section.

result_cf() outputs total cashflows of all the model points,

and result_pv() outputs the present values of the cashflows

by model points.

Both Cells outputs the results as pandas DataFrame.

By following the same steps explained in the Quick Start page using this model, You can get the results in an MxConsole and show the results as tables in MxDataViewer.

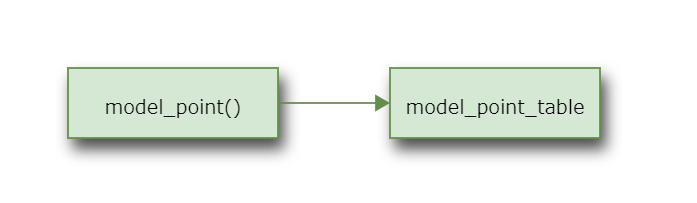

Changing the model point#

By default, model_point() returns the entire model_point_table:

>>> Projection.model_point.formula

def model_point():

return model_point_table

The calculations in Projection apply to all the model points

in model_point_table.

To limit the calculation target, change the model_point() formula

so that model_point() returns a DataFrame that contains

only the target rows.

For example, to select only the model point 1:

>>> Projection.model_point.formula

def model_point():

return model_point_table.loc[1:1]

There are many methods of DataFrame for selecting its rows. See the pandas documentation for details.

When selecting only one model point, make sure that model_point()

returns the model point as a DataFrame not as a Series.

In the code example above, model_point_table.loc[1:1]

is specified instead of model_point_table.loc[1],

because model_point_table.loc[1] would return the model point as a Series.

Also, you should be careful not to accidentally update the original DataFrame

held as model_point_table.

Model Specifications#

The BasicTerm_ME model has only one UserSpace,

named Projection,

and all the Cells and References are defined in the space.

The Projection Space#

The main Space in the BasicTerm_ME model.

Projection is the only Space defined

in the BasicTerm_ME model, and it contains

all the logic and data used in the model.

Parameters and References

(In all the sample code below,

the global variable Projection refers to the

Projection Space.)

- model_point_table#

All model points as a DataFrame. The sample model point data was generated by generate_model_points_with_duration.ipynb included in the library. By default,

model_point()returns this entiremodel_point_table. The DataFrame has an index namedpoint_id, and has the following columns:age_at_entrysexpolicy_termpolicy_countsum_assuredduration_mth

Cells defined in

Projectionwith the same names as these columns return the corresponding columns.>>> Projection.model_poit_table age_at_entry sex ... sum_assured duration_mth policy_id ... 1 47 M ... 622000 1 2 29 M ... 752000 210 3 51 F ... 799000 15 4 32 F ... 422000 125 5 28 M ... 605000 55 ... .. ... ... ... 9996 47 M ... 827000 157 9997 30 M ... 826000 168 9998 45 F ... 783000 146 9999 39 M ... 302000 11 10000 22 F ... 576000 166 [10000 rows x 6 columns]

The DataFrame is saved in the Excel file model_point_table.xlsx placed in the model folder.

model_point_tableis created by Projection’s new_pandas method, so that the DataFrame is saved in the separate file. The DataFrame has the injected attribute of_mx_dataclident:>>> Projection.model_point_table._mx_dataclient <PandasData path='model_point_table.xlsx' filetype='excel'>

Premium rate table by entry age and duration as a Series. The table is created using

BasicTerm_Mas demonstrated in create_premium_table.ipynb. The table is stored in premium_table.xlsx in the model folder.>>> Projection.premium_table age_at_entry policy_term 20 10 0.000046 15 0.000052 20 0.000057 21 10 0.000048 15 0.000054 ... 58 15 0.000433 20 0.000557 59 10 0.000362 15 0.000471 20 0.000609 Name: premium_rate, Length: 120, dtype: float64

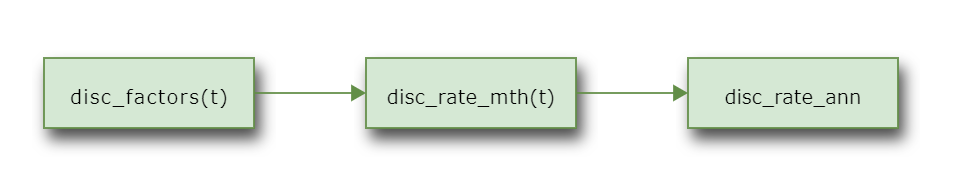

- disc_rate_ann#

Annual discount rates by duration as a pandas Series.

>>> Projection.disc_rate_ann year 0 0.00000 1 0.00555 2 0.00684 3 0.00788 4 0.00866 146 0.03025 147 0.03033 148 0.03041 149 0.03049 150 0.03056 Name: disc_rate_ann, Length: 151, dtype: float64

The Series is saved in the Excel file disc_rate_ann.xlsx placed in the model folder.

disc_rate_annis created by Projection’s new_pandas method, so that the Series is saved in the separate file. The Series has the injected attribute of_mx_dataclident:>>> Projection.disc_rate_ann._mx_dataclient <PandasData path='disc_rate_ann.xlsx' filetype='excel'>

See also

- mort_table#

Mortality table by age and duration as a DataFrame. See basic_term_sample.xlsx included in this library for how the sample mortality rates are created.

>>> Projection.mort_table 0 1 2 3 4 5 Age 18 0.000231 0.000254 0.000280 0.000308 0.000338 0.000372 19 0.000235 0.000259 0.000285 0.000313 0.000345 0.000379 20 0.000240 0.000264 0.000290 0.000319 0.000351 0.000386 21 0.000245 0.000269 0.000296 0.000326 0.000359 0.000394 22 0.000250 0.000275 0.000303 0.000333 0.000367 0.000403 .. ... ... ... ... ... ... 116 1.000000 1.000000 1.000000 1.000000 1.000000 1.000000 117 1.000000 1.000000 1.000000 1.000000 1.000000 1.000000 118 1.000000 1.000000 1.000000 1.000000 1.000000 1.000000 119 1.000000 1.000000 1.000000 1.000000 1.000000 1.000000 120 1.000000 1.000000 1.000000 1.000000 1.000000 1.000000 [103 rows x 6 columns]

The DataFrame is saved in the Excel file mort_table.xlsx placed in the model folder.

mort_tableis created by Projection’s new_pandas method, so that the DataFrame is saved in the separate file. The DataFrame has the injected attribute of_mx_dataclident:>>> Projection.mort_table._mx_dataclient <PandasData path='mort_table.xlsx' filetype='excel'>

See also

Projection parameters#

This is a new business model and all model points are issued at time 0.

The time step of the model is monthly. Cashflows and other time-dependent

variables are indexed with t.

Cashflows and other flows that accumulate throughout a period

indexed with t denotes the sums of the flows from t til t+1.

Balance items indexed with t denotes the amount at t.

|

Projection length in months |

The max of all projection lengths |

Model point data#

The model point data is stored in an Excel file named model_point_table.xlsx under the model folder.

Target model points |

|

|

The sex of the model points |

The sum assured of the model points |

|

The policy term of the model points. |

|

|

The attained age at time t. |

The age at entry of the model points |

|

|

Duration of model points at |

|

Duration of model points at |

Assumptions#

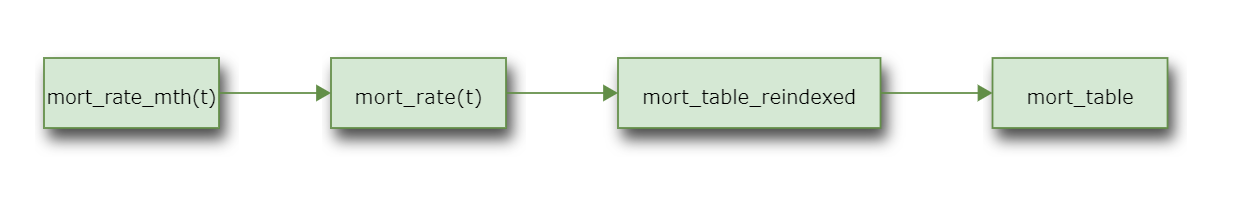

The mortality table is stored in an Excel file named mort_table.xlsx

under the model folder, and is read into mort_table as a DataFrame.

mort_table_reindexed() returns a mortality table

reshaped from mort_table, which is a Series

indexed with Age and Duration.

mort_rate() looks up mort_table_reindexed() and picks up

the annual mortality rates to be applied for all the

model points at time t and returns them in a Series.

mort_rate_mth() converts mort_rate() to the monthly mortality

rate to be applied during the month starting at time t.

The discount rate data is stored in an Excel file named disc_rate_ann.xlsx

under the model folder, and is read into disc_rate_ann as a Series.

The lapse by duration is defined by a formula in lapse_rate().

expense_acq() holds the acquisition expense per policy at t=0.

expense_maint() holds the maintenance expense per policy per annum.

The maintenance expense inflates at a constant rate

of inflation given as inflation_rate().

|

Mortality rate to be applied at time t |

Monthly mortality rate to be applied at time t |

|

MultiIndexed mortality table |

|

Discount factors. |

|

Monthly discount rate |

|

|

Lapse rate |

Acquisition expense per policy |

|

Annual maintenance expense per policy |

|

The inflation factor at time t |

|

Inflation rate |

Policy values#

By default, the amount of death benefit for each policy (claim_pp())

is set equal to sum_assured.

The payment method is monthly whole term payment for all model points.

The monthly premium per policy (premium_pp())

is calculated for each policy

as (1 + loading_prem()) times net_premium_pp().

The net premium is calculated so that the present value of the

net premiums equates to the present values of claims.

This product is assumed to have no surrender value.

|

Claim per policy |

Net premium per policy |

|

Loading per premium |

|

Monthly premium per policy |

Policy decrement#

The initial number of policies is set to 1 per model point by default, and decreases through out the policy term by lapse and death. At the end of the policy term the remaining number of policies mature.

|

Number of death occurring at time t |

|

Number of policies in-force |

|

Number of policies in-force |

Initial number of policies in-force |

|

|

Number of lapse occurring at time t |

Number of maturing policies |

|

|

Number of new business policies |

Cashflows#

An acquisition expense at t=0 and maintenance expenses thereafter comprise expense cashflows.

Commissions are assumed to be paid out during the first year and the commission amount is assumed to be 100% premium during the first year and 0 afterwards.

|

Claims |

|

Commissions |

|

Premium income |

|

Expenses |

|

Net cashflow |

Present values#

The Cells whose names start with pv_ are for calculating

the present values of the cashflows indicated by the rest of their names.

pols_if() is not a cashflow, but used as annuity factors

in calculating net_premium_pp().

Present value of claims |

|

Present value of commissions |

|

Present value of expenses |

|

Present value of net cashflows. |

|

Present value of policies in-force |

|

Present value of premiums |

Results#

result_cf() outputs the total cashflows of all the model points

as a DataFrame:

>>> result_cf()

Premiums Claims Expenses Commissions Net Cashflow

0 3.481375e+07 2.551366e+07 2.722470e+06 2.304871e+06 4.272750e+06

1 3.458612e+07 2.533530e+07 2.777227e+06 2.271010e+06 4.202583e+06

2 3.460642e+07 2.532024e+07 2.992697e+06 2.316894e+06 3.976592e+06

3 3.446821e+07 2.526094e+07 2.816155e+06 2.308385e+06 4.082731e+06

4 3.440382e+07 2.527465e+07 2.896164e+06 2.319160e+06 3.913840e+06

.. ... ... ... ... ...

272 1.509838e+05 2.281406e+05 8.909740e+03 0.000000e+00 -8.606662e+04

273 1.292070e+05 1.969228e+05 6.464827e+03 0.000000e+00 -7.418061e+04

274 9.360930e+04 1.447365e+05 4.187218e+03 0.000000e+00 -5.531445e+04

275 5.851123e+04 9.225161e+04 1.942107e+03 0.000000e+00 -3.568248e+04

276 0.000000e+00 0.000000e+00 0.000000e+00 0.000000e+00 0.000000e+00

[277 rows x 5 columns]

result_pv() outputs the present values of the cashflows by model points:

>>> result_pv()

PV Premiums PV Claims ... PV Commissions PV Net Cashflow

policy_id ...

1 7.083791e+05 474803.297001 ... 85874.887301 108798.061916

2 9.950994e+04 109613.723658 ... 0.000000 -18305.709146

3 1.104613e+06 802437.653322 ... 0.000000 266073.249126

4 2.839117e+05 264723.616424 ... 0.000000 -18224.092562

5 4.399130e+05 352234.521794 ... 0.000000 32214.118896

... ... ... ... ...

9996 3.574210e+05 405869.354038 ... 0.000000 -58052.929127

9997 5.917467e+04 59908.482977 ... 0.000000 -5547.111546

9998 1.314719e+05 141951.671002 ... 0.000000 -14790.802910

9999 5.615703e+04 39215.159798 ... 372.420000 9219.186564

10000 7.927437e+03 7433.441293 ... 0.000000 -752.642292

[10000 rows x 5 columns]

Result table of cashflows |

|

Result table of present value of cashflows |

|

Result table of policy decrement |

Cells Descriptions#

- proj_len()[source]#

Projection length in months

proj_len()returns how many months the projection for each model point should be carried out for all the model point. Defined as:np.maximum(12 * policy_term() - duration_mth(0) + 1, 0)

Since this model carries out projections for all the model points simultaneously, the projections are actually carried out from 0 to

max_proj_lenfor all the model points.See also

- max_proj_len()#

The max of all projection lengths

Defined as

max(proj_len())See also

- model_point()[source]#

Target model points

Returns as a DataFrame the model points to be in the scope of calculation. By default, this Cells returns the entire

model_point_tablewithout change. To select model points, change this formula so that this Cells returns a DataFrame that contains only the selected model points.Examples

To select only the model point 1:

def model_point(): return model_point_table.loc[1:1]

To select model points whose ages at entry are 40 or greater:

def model_point(): return model_point_table[model_point_table["age_at_entry"] >= 40]

Note that the shape of the returned DataFrame must be the same as the original DataFrame, i.e.

model_point_table.When selecting only one model point, make sure the returned object is a DataFrame, not a Series, as seen in the example above where

model_point_table.loc[1:1]is specified instead ofmodel_point_table.loc[1].Be careful not to accidentally change the original table.

- sex()[source]#

The sex of the model points

Note

This cells is not used by default.

The

sexcolumn of the DataFrame returned bymodel_point().

- sum_assured()[source]#

The sum assured of the model points

The

sum_assuredcolumn of the DataFrame returned bymodel_point().

- policy_term()[source]#

The policy term of the model points.

The

policy_termcolumn of the DataFrame returned bymodel_point().

- age_at_entry()[source]#

The age at entry of the model points

The

age_at_entrycolumn of the DataFrame returned bymodel_point().

- duration_mth(t)[source]#

Duration of model points at

tin monthsIndicates how many months the policies have been in-force at

t. The initial values at time 0 are read from theduration_mthcolumn inmodel_point_tablethroughmodel_point(). Increments by 1 astincrements. Negative values ofduration_mth()indicate future new business policies. For example, If theduration_mth()is -15 at time 0, the model point is issued att=15.See also

- mort_rate(t)[source]#

Mortality rate to be applied at time t

Returns a Series of the mortality rates to be applied at time t. The index of the Series is

point_id, copied frommodel_point().

- mort_table_reindexed()[source]#

MultiIndexed mortality table

Returns a Series of mortlity rates reshaped from

mort_table. The returned Series is indexed by age and duration capped at 5.

- disc_factors()[source]#

Discount factors.

Vector of the discount factors as a Numpy array. Used for calculating the present values of cashflows.

See also

- disc_rate_mth()[source]#

Monthly discount rate

Nummpy array of monthly discount rates from time 0 to

max_proj_len()- 1 defined as:(1 + disc_rate_ann)**(1/12) - 1

See also

- lapse_rate(t)[source]#

Lapse rate

By default, the lapse rate assumption is defined by duration as:

max(0.1 - 0.02 * duration(t), 0.02)

See also

- claim_pp(t)[source]#

Claim per policy

The claim amount per plicy. Defaults to

sum_assured().

Net premium per policy

Note

This cells is not used by default.

The net premium per policy is defined so that the present value of net premiums equates to the present value of claims:

pv_claims() / pv_pols_if()

See also

- loading_prem()[source]#

Loading per premium

Note

This cells is not used by default.

0.5by default.See also

Monthly premium per policy

A Series of monthly premiums per policy for all the model points, calculated as:

np.around(sum_assured() * prem_rates, 2)

where the

prem_ratesis a Series of premium rates retrieved frompremium_table.

- pols_if(t)[source]#

Number of policies in-force

pols_if(t)is an alias forpols_if_at(t, "BEF_MAT").See also

- pols_if_at(t, timing)[source]#

Number of policies in-force

pols_if_at(t, timing)calculates the number of policies in-force at timet. The second parametertimingtakes a string value to indicate the timing of in-force, which is either"BEF_MAT","BEF_NB"or"BEF_DECR".BEF_MAT

The number of policies in-force before maturity after lapse and death. At time 0, the value is read from

pols_if_init(). For time > 0, defined as:pols_if_at(t-1, "BEF_DECR") - pols_lapse(t-1) - pols_death(t-1)

BEF_NB

The number of policies in-force before new business after maturity. Defined as:

pols_if_at(t, "BEF_MAT") - pols_maturity(t)

BEF_DECR

The number of policies in-force before lapse and death after new business. Defined as:

pols_if_at(t, "BEF_NB") + pols_new_biz(t)

- pols_if_init()[source]#

Initial number of policies in-force

Number of in-force policies at time 0 referenced from

pols_if_at(0, "BEF_MAT").

- pols_maturity(t)[source]#

Number of maturing policies

The policy maturity occurs when

duration_mth()equals 12 timespolicy_term(). The amount is equal topols_if_at(t, "BEF_MAT").otherwise

0.

- pols_new_biz(t)[source]#

Number of new business policies

The number of new business policies. The value

duration_mth(0)for the selected model point is read from thepolicy_countcolumn inmodel_point(). If the value is 0 or negative, the model point is new business at t=0 or at t whenduration_mth(t)is 0, and thepols_new_biz(t)is read from thepolicy_countinmodel_point().See also

- claims(t)[source]#

Claims

Claims during the period from

ttot+1defined as:claim_pp(t) * pols_death(t)

See also

- commissions(t)[source]#

Commissions

By default, 100% premiums for the first year, 0 otherwise.

See also

Premium income

Premium income during the period from

ttot+1defined as:premium_pp() * pols_if_at(t, "BEF_DECR")

See also

- expenses(t)[source]#

Expenses

Expenses during the period from

ttot+1defined as the sum of acquisition expenses and maintenance expenses. The acquisition expenses are modeled asexpense_acq()timespols_new_biz(). The maintenance expenses are modeled asexpense_maint()timesinflation_factor()timespols_if_at()before decrement.

- net_cf(t)[source]#

Net cashflow

Net cashflow for the period from

ttot+1defined as:premiums(t) - claims(t) - expenses(t) - commissions(t)

See also

- pv_net_cf()[source]#

Present value of net cashflows.

Defined as:

pv_premiums() - pv_claims() - pv_expenses() - pv_commissions()

- pv_pols_if()[source]#

Present value of policies in-force

Note

This cells is not used by default.

The discounted sum of the number of in-force policies at each month. It is used as the annuity factor for calculating

net_premium_pp().

Present value of premiums

See also