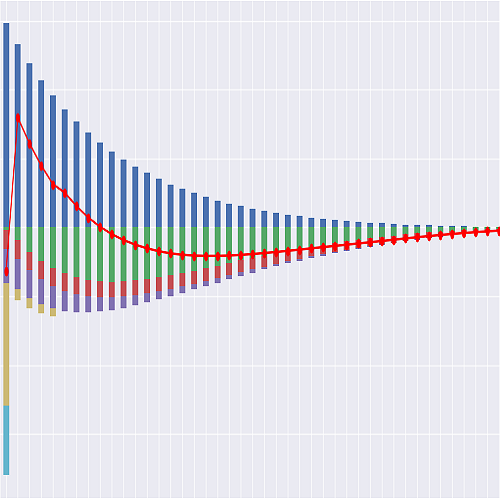

Risk free curve test#

The risk free curve is one of the principal inputs into an economic scenario generator. This test recalculates the risk free curve using the parameters that are claimed to be used.

This example#

In this example, we look at the EIOPA risk free rate publication from August 2022. In particular, this example focuses on the EUR curve. The publication can be found EIOPA RFR website.

The observed maturities M_Obs and the calibrated vector Qb can be found in the Excel sheet EIOPA_RFR_20220831_Qb_SW.xlsx.

The target maturities (T_Obs), the additional parameters (UFR and alpha) and the given curve can be found in the Excel EIOPA_RFR_20220831_Term_Structures.xlsx, sheet RFR_spot_no_VA.

Smith&Wilson algorithm#

The implementation of the SW algorithm is a slight modification to the original OSM implementation. The original implementation can be found in different languages on the OSM’s GitHub repository: