"""The main Space in the :mod:`~assets.BasicBonds` model.

.. rubric:: Parameters and References

(In all the sample code below,

the global variable ``Bonds`` refers to the

:mod:`~assets.BasicBonds.Bonds` space.)

Attributes:

ql: The `QuantLib <https://www.quantlib.org/>`_ module.

date_init: Valuation date as a string in the form of 'YYYY-MM-DD'.

date_end: Projection end date as a string in the form of 'YYYY-MM-DD'.

zero_curve: Zero curve at the valuation date as a pandas Series

indexed with strings indicating various durations.

This data is used by :func:`riskfree_curve` to create

QuantLib's ZeroCurve object::

>>> Bonds.zero_curve

Duration

1M 0.0004

2M 0.0015

3M 0.0026

6M 0.0057

1Y 0.0091

2Y 0.0136

3Y 0.0161

5Y 0.0182

7Y 0.0192

10Y 0.0194

20Y 0.0231

30Y 0.0225

Name: Rate, dtype: float64

The data is saved as an Excel file named "zero_curve.xlsx" in the

model.

bond_data: Bond data as a pandas DataFrame.

By default, a sample table generated by the

*generate_bond_data.ipynb* notebook included in the library::

>>> Bonds.bond_data

settlement_days face_value issue_date ... tenor coupon_rate z_spread

bond_id ...

1 0 235000 2017-12-12 ... 1Y 0.07 0.0304

2 0 324000 2021-11-29 ... 1Y 0.08 0.0304

3 0 799000 2017-02-03 ... 6M 0.03 0.0155

4 0 679000 2017-11-19 ... 1Y 0.08 0.0229

5 0 397000 2018-07-01 ... 6M 0.06 0.0142

... ... ... ... ... ... ...

996 0 560000 2019-02-16 ... 1Y 0.06 0.0261

997 0 161000 2020-03-12 ... 6M 0.05 0.0199

998 0 375000 2019-05-05 ... 1Y 0.03 0.0138

999 0 498000 2019-02-21 ... 1Y 0.03 0.0230

1000 0 438000 2019-03-14 ... 1Y 0.06 0.0256

[1000 rows x 8 columns]

The column names and their data types are as follows::

>>> Bonds.bond_data.dtypes

settlement_days int64

face_value int64

issue_date datetime64[ns]

bond_term int64

maturity_date datetime64[ns]

tenor object

coupon_rate float64

z_spread float64

dtype: object

The data is saved as an Excel file named "bond_data.xlsx" in the

model.

"""

from modelx.serialize.jsonvalues import *

_formula = None

_bases = []

_allow_none = None

_spaces = []

# ---------------------------------------------------------------------------

# Cells

[docs]

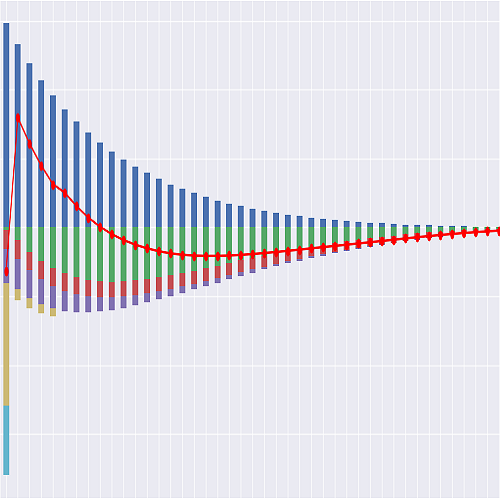

def cashflows(bond_id):

"""Returns the cashflows of the selected bond.

Returns the cashflows of the selected bond as a list.

Each element of the list is the total

cashflows falling in each projection period defined by :func:`date_`.

"""

result = [0] * step_size()

leg = fixed_rate_bond(bond_id).cashflows()

i = 0 # cashflow index

for t in range(step_size()):

while i < len(leg):

if i > 0:

# Check if cashflow dates are in order.

assert leg[i-1].date() <= leg[i].date()

if date_(t) <= leg[i].date() < date_(t+1):

result[t] += leg[i].amount()

elif date_(t+1) <= leg[i].date():

break

i += 1

return result

[docs]

def cashflows_total():

"""Returns the aggregated cashflows of the entire bond portfolio.

Takes the sum of :func:`cashflows` across ``bond_id`` and

returns as a list the aggregated cashflows of all the bonds

in :attr:`bond_data`.

"""

result = [0] * step_size()

for t in range(step_size()):

for i in bond_data.index:

result[t] += cashflows(i)[t]

return result

[docs]

def date_(i):

"""Date at each projection step

Defines projection time steps by returning QuantLib's `Date`_ object

that corresponds to the value of the integer index ``i``.

By default, ``date_(i)`` starts from the valuation date specified

by :attr:`date_init`, and increments annually.

.. _Date:

https://www.quantlib.org/reference/class_quant_lib_1_1_date.html

"""

if i == 0:

return ql.Date(date_init, "%Y-%m-%d")

else:

return date_(i-1) + ql.Period('1Y')

[docs]

def fixed_rate_bond(bond_id):

"""Returns QuantLib’s `FixedRateBond`_ object

Create QuantLib’s `FixedRateBond`_ object

representing a bond specified by the given bond ID.

The bond object is created from the attributes in :attr:`bond_data`

and :func:`schedule`.

A pricing engine for the bond object is created as a `DiscountingBondEngine`_ object

from :func:`riskfree_curve` and the ``z_spread`` attribute in :attr:`bond_data`,

and associated with the bond object through a `ZeroSpreadedTermStructure`_ object.

.. _FixedRateBond:

https://www.quantlib.org/reference/class_quant_lib_1_1_fixed_rate_bond.html

.. _DiscountingBondEngine:

https://quantlib-python-docs.readthedocs.io/en/latest/pricing_engines/bonds.html

.. _ZeroSpreadedTermStructure:

https://www.quantlib.org/reference/class_quant_lib_1_1_zero_spreaded_term_structure.html

"""

settlement_days = bond_data.loc[bond_id]['settlement_days']

face_value = bond_data.loc[bond_id]['face_value']

coupons = [bond_data.loc[bond_id]['coupon_rate']]

bond = ql.FixedRateBond(

int(settlement_days),

float(face_value),

schedule(bond_id),

coupons,

ql.Actual360(), # DayCount

ql.Unadjusted)

spread = bond_data.loc[bond_id]['z_spread']

spread = ql.QuoteHandle(ql.SimpleQuote(spread))

disc_curve = ql.ZeroSpreadedTermStructure(

ql.YieldTermStructureHandle(riskfree_curve()), spread,

ql.Compounded, ql.Annual)

# Set discount curve

bondEngine = ql.DiscountingBondEngine(

ql.YieldTermStructureHandle(disc_curve))

bond.setPricingEngine(bondEngine)

return bond

[docs]

def redemptions(bond_id):

"""Returns cashflows of redemptions

For the specified bond, returns a list of redemptions cashflows.

Since the redemption cashflow occurs only once,

all but one element are zero.

"""

result = [0] * step_size()

leg = fixed_rate_bond(bond_id).redemptions()

i = 0 # cashflow index

for t in range(step_size()):

while i < len(leg):

if date_(t) <= leg[i].date() < date_(t+1):

result[t] += leg[i].amount()

elif date_(t+1) <= leg[i].date():

break

i += 1

return result

[docs]

def redemptions_total():

"""Returns all redemption cashflows

Returns a list of redemptions of all the bonds in :attr:`bond_data`.

"""

result = [0] * step_size()

for t in range(step_size()):

for i in bond_data.index:

result[t] += redemptions(i)[t]

return result

[docs]

def riskfree_curve():

"""Returns `ZeroCurve`_ object

Creates QuantLib's `ZeroCurve`_ object from :attr:`zero_curve` and returns it.

The `ZeroCurve`_ object is used by :func:`fixed_rate_bond` to

construct a discount curve for calculating the market value of the specified bond.

.. _ZeroCurve:

https://www.quantlib.org/reference/group__yieldtermstructures.html

"""

ql.Settings.instance().evaluationDate = date_(0)

spot_dates = [date_(0)] + list(date_(0) + ql.Period(dur) for dur in zero_curve.index)

spot_rates = [0] + list(zero_curve)

return ql.ZeroCurve(

spot_dates,

spot_rates,

ql.Actual360(), # dayCount

ql.UnitedStates(ql.UnitedStates.Settlement), # calendar

ql.Linear(), # Interpolator

ql.Compounded, # compounding

ql.Annual # frequency

)

[docs]

def schedule(bond_id):

"""Returns a `Schedule`_ object

Create QuantLib's `Schedule`_ object for the specified bond and returns it.

The returned `Schedule`_ object is used to by :func:`fixed_rate_bond`

to construct `FixedRateBond`_ object.

.. _Schedule:

https://www.quantlib.org/reference/class_quant_lib_1_1_schedule.html

.. _FixedRateBond:

https://www.quantlib.org/reference/class_quant_lib_1_1_fixed_rate_bond.html

"""

d = bond_data.loc[bond_id]['issue_date']

issue_date = ql.Date(d.day, d.month, d.year)

d = bond_data.loc[bond_id]['maturity_date']

maturity_date = ql.Date(d.day, d.month, d.year)

tenor = ql.Period(

ql.Semiannual if bond_data.loc[bond_id]['tenor'] == '6Y' else ql.Annual)

return ql.Schedule(

issue_date,

maturity_date,

tenor,

ql.UnitedStates(ql.UnitedStates.Settlement), # calendar

ql.Unadjusted, # convention

ql.Unadjusted , # terminationDateConvention

ql.DateGeneration.Backward, # rule

False # endOfMonth

)

[docs]

def step_size():

"""Returns the number of time steps

Calculates the number of time steps from :attr:`date_end`

and :func:`date_` ren returns it.

"""

d_end = ql.Date(date_end, "%Y-%m-%d")

t = 0

while True:

if date_(t) < d_end:

t += 1

else:

return t

[docs]

def z_spread_recalc(bond_id):

"""Calculate Z-spread

For the bond specified by ``bond_id``,

Calculate the Z-spread of the bond specified by ``bond_id`` from

the bond's market value and :func:`riskfree_curve`.

This is for testing that the calculated Z-spread matches the input in :attr:`bond_data`.

"""

return ql.BondFunctions.zSpread(

fixed_rate_bond(bond_id),

fixed_rate_bond(bond_id).cleanPrice(),

riskfree_curve(),

ql.Thirty360(), ql.Compounded, ql.Annual)

[docs]

def market_values():

"""Returns the market values of the entire bonds

Calculates and Returns a list of the market values of :func:`fixed_rate_bond`

for all bonds input in :attr:`bond_data`.

"""

bond = fixed_rate_bond

return list(

bond(i).notional() * bond(i).cleanPrice() / 100

for i in bond_data.index)

# ---------------------------------------------------------------------------

# References

date_end = "2053-01-01"

date_init = "2022-01-01"

bond_data = ("DataSpec", 2323236992288, 2323228088304)

ql = ("Module", "QuantLib")

zero_curve = ("DataSpec", 2323237349888, 2323227835552)